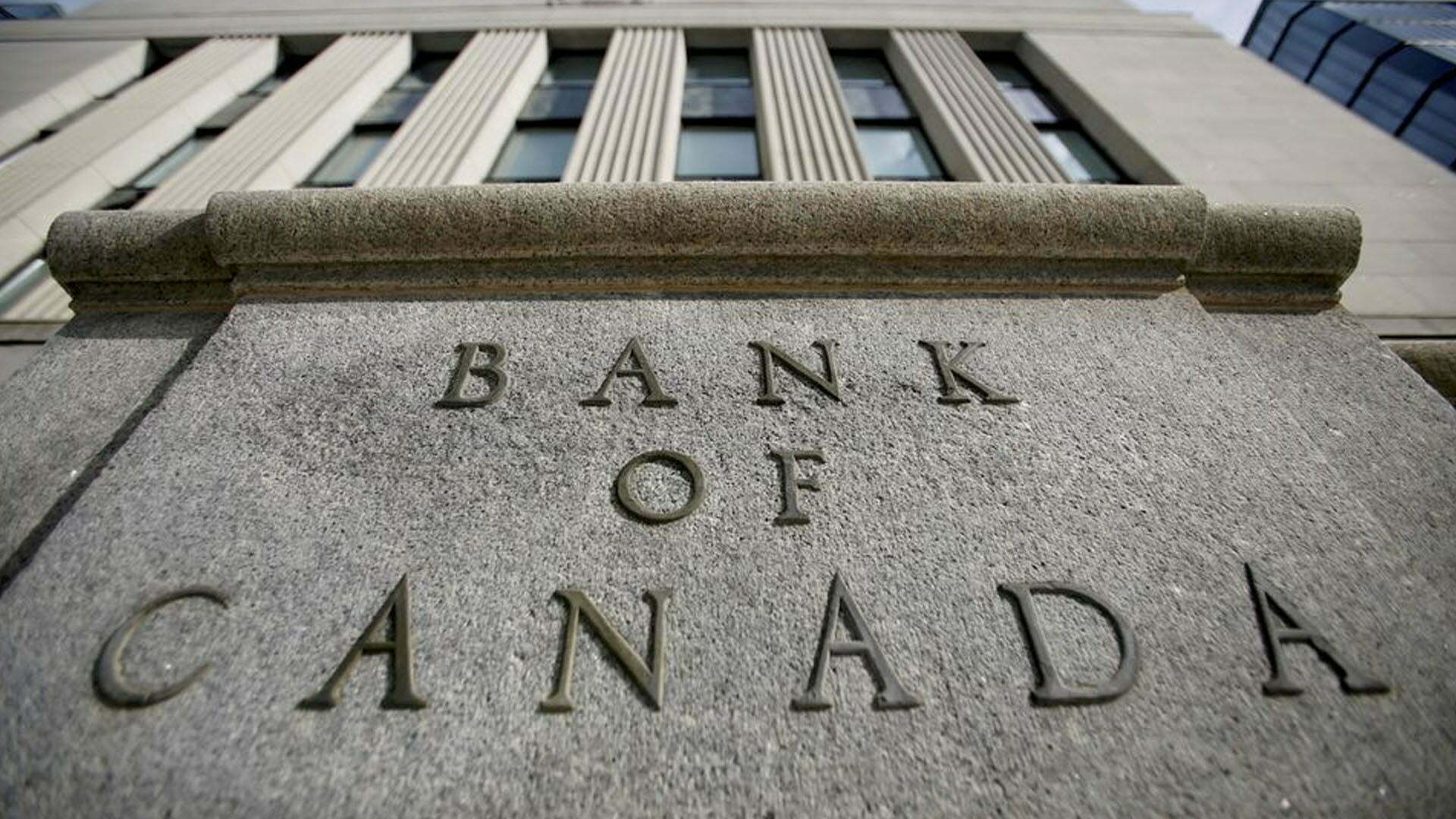

Bank of Canada Ottawa (Reuters) announced an agreement with the federal government on Monday to keep its inflation target at 2%, adding that it will also take into account labor market factors.

This decision was set out in a new five-year monetary policy framework between the Central Bank and the Ministry of Finance.

Banks have taken a flexible approach to manage the turmoil caused by the pandemic, allowing supply chain bottlenecks and rising energy prices to boost total costs while recovering the labor market and economy. I am doing it. Inflation reached 4.7% in October, the highest in 18 years, surpassing 3% for the seventh straight month. Banks expect to fall next year, suggesting that critical rates could be raised from a record low of 0.25% as early as April.

“When the economy is under pressure, interest rates can be kept low for a very long period,” said Doug Porter, chief economist at BMO Capital Markets, with flexibility in pricing.

“This is primarily a continuation of what has already done and systematized the approach during the pandemic,” said Joshnai, Chief Economist at RBC Economics.

Treasury Secretary Chrystia Freeland told reporters that the framework is an exercise of transparency that highlights banks’ actions in a “world of uncertainty and volatility.”

As the central bank decided last year, financial institutions, and thus the ministry, oppose significant changes in monetary policy strategies. Reuters rumored the details of last week’s announcement.

The main forces of the financial organizations mentioned above, such as demographics and technological changes, severely impact the market while making it more permanent to measure most real estate jobs to the extent that inflationary pressures occur. I made it. He said that if the

condition is guaranteed, the flexibility of the 1% 3% shot range can be used to track most real estate jobs and collectively influence low rates structurally.

Rice field. Longer than usual. ” The interest rate is already so low that there is less room to lower it in the face of the economic shock.

The Agreement

“This agreement sets out our goals and how we can leverage and leverage the flexibility built into our framework,” Bank of Canada Governor McClem told reporters.

Macklem mentioned that various measures would be accustomed to tracking market developments.

On Monday, concern regarding the letter variant weighed on world money markets.

During the morning, the dollar weakened by zero.5% to 1.2785 per U.S. dollar or 78.22 U.S. cents. In contrast, Canada’s 10year yield touched its lowest level since Sept. 27 at 1.389%, down from the maximum amount as seven. Six basis points on the day.

Source: Reuters.com